Last month, Lauder Teacher hosted the latest session in our Think-In series, focusing on purpose-built student accommodation (PBSA) in Ireland. We were joined by John Jacobs, Global Head of Capital Markets at Global Student Accommodation (GSA), and Aaron Bailey, GSA’s Head of Real Estate. GSA is one of the sector’s pioneers internationally and is the largest owner of, and investor in, PBSA in Ireland, with close to 4,000 beds across Dublin and Cork. The discussion was refreshingly candid and grounded in two decades of global experience, and a decade in the sector in Ireland.

Three themes stood out.

First, demand is not the problem. Ireland has more than 260,000 higher-education students, including over 40,000 international students, and the trend is upward. John noted the broader global context, with sustained growth in tertiary participation and the expanding middle class across Asia and Africa. The Irish market mirrors this pattern. Students, their parents, and universities want safe, well-managed, proximate housing with certainty of cost. That is what PBSA provides. As owners, and alongside their operating partner Yugo, GSA are at or near full occupancy each year. International students tend to book earlier, prioritising safety, connectivity, and service. The result is a demand profile that is resilient across cycles.

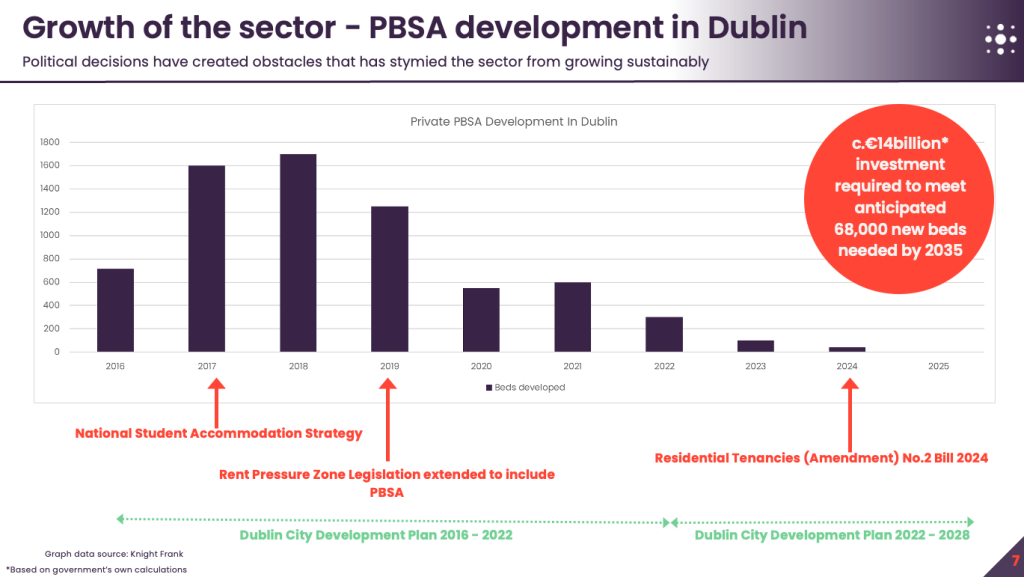

Second, supply is the challenge, and trust is the missing ingredient. Aaron set out the timeline. The early years of sector formation saw genuine partnership between central government, local authorities, and responsible developers. The National Student Accommodation Strategy enabled a wave of delivery in 2017 to 2019. Since then, delivery has fallen away. The reasons are well rehearsed, yet require emphasis. Rent Pressure Zone rules were extended to PBSA in 2019, with caps reduced to 2 percent in 2021. Over the same period, the model has been subject to a dozen material policy changes. This instability has damaged confidence and, crucially, exit-yield visibility. As John put it, core, long-duration capital needs policy clarity to underwrite an exit for development capital. Without a predictable exit, new schemes do not get financed. Construction costs and planning friction matter, but they are not the primary blockers. The bottleneck is the ability to attract core capital at credible yields in a regime that investors trust.

Third, policy must focus on clarity, consistency, and product diversity. Both speakers argued for structured, ongoing engagement between government, universities, and the private sector. That means bringing operators and long-term investors into the room early, and keeping them there. It also means recognising that PBSA is an operational housing product with different cost drivers to traditional apartments. Irish space and amenity standards are materially higher than many peer markets. That produces great buildings, yet has consequences for affordability. A one-size specification will not serve a student population with diverse needs and budgets. The most successful assets blend clusters, smaller rooms, and studios in the same building. This is not a race to the bottom. It is a recognition that choice is essential if we are to deliver both affordability and quality.

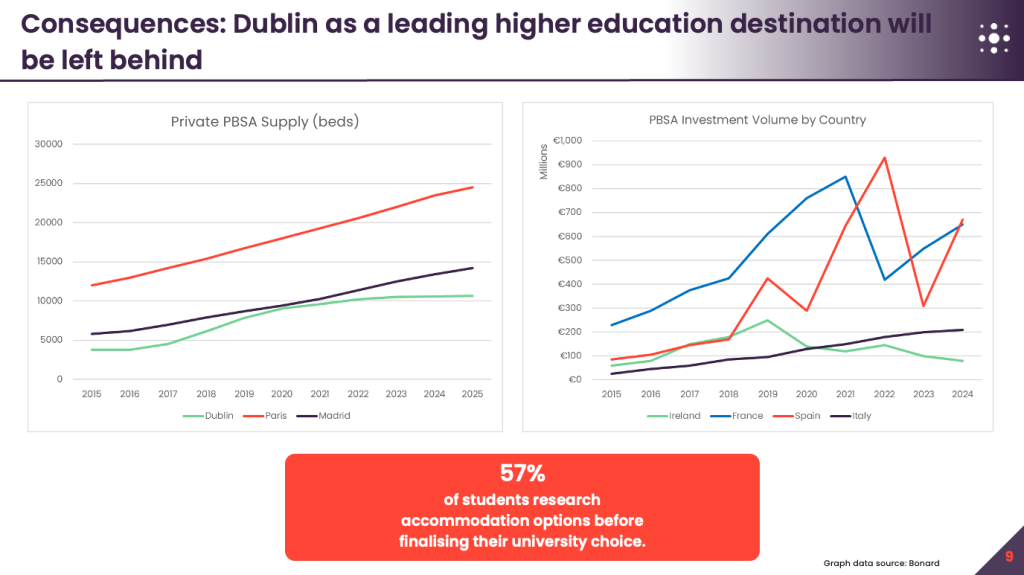

The conversation also explored the wider economic stakes. International education is a strategic export. It brings fee income to universities, research funding, and spending into local economies. GSA estimate that international students contribute well over a billion euro each year when tuition and living costs are combined. There is a parallel link to foreign direct investment. Ireland’s skills base and graduate pipelines are central to our competitiveness. If students cannot find housing, enrolment falls, university rankings suffer, and future business connections are lost. The student euro is not a niche consideration. It is part of Ireland’s long-term growth model.

What, then, should change? Three practical steps emerged.

First, regulatory clarity. PBSA needs a clear framework for rent setting and indexation that balances affordability and viability. Rules should be simple, durable, and targeted to student housing rather than borrowed wholesale from private rented-sector policy. Once agreed, they should be held steady for a defined period. Investors can price certainty, even where they dislike specific rules.

Second, standards with flexibility. Ireland can maintain high quality while aligning space and amenity standards with international benchmarks that have proven to deliver affordability. A calibrated approach would permit more compact, well-designed rooms and balanced amenity packages, while preserving accessibility, safety, and sustainability.

Third, public and private working together at scale. Long-term nomination agreements can anchor affordability for students and create occupancy certainty for developers and lenders. Where appropriate, a Part V-style mechanism would allow universities or local authorities to acquire a defined share of beds at cost-rental for direct allocation, rather than imposing blunt, fixed quotas that risk undermining viability. This is an area where Ireland can move quickly, drawing on international practice and the experience of operators already delivering nominations with universities across Europe, North America, and Australia.

We also discussed PBSA’s role in the broader housing system. For every two student beds delivered, a traditional residential unit is freed up, easing pressure on the rental market. That is not theory. It is borne out by experience. PBSA is one lever among many, yet it is a lever we can pull faster than most, provided finance, planning, and standards are aligned.

The call concluded with two clear messages. From John, a call for genuine consultation and partnership. From Aaron, a plea for stability. Decide, communicate, and hold the line. If we can restore trust, capital will follow, and supply will resume. The upside is significant: more beds for students, less pressure on family housing, stronger universities, and a more competitive Ireland.

At Lauder Teacher, we will continue convening this debate with data, international case studies, and voices from across the ecosystem. My thanks to John Jacobs and Aaron Bailey for sharing their insights, and to the many participants who joined and contributed questions.