The high-profile sale of Blanchardstown by Goldman Sachs to Strategic Value Partners (SVP) late last year played a major role in this, but the wider investment market appetite is equally notable.

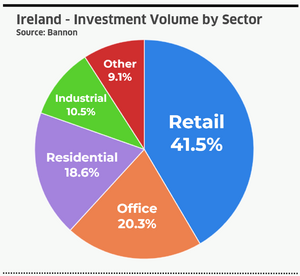

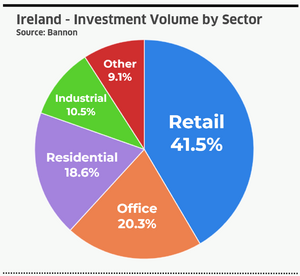

For the first time since 2016, retail was the most invested-in sector in Ireland in 2024. While the Blanchardstown €575 million deal was a driving force, retail maintained its lead in the first three quarters of the year, underscoring investor confidence in the sector.

Some argue that the sector’s downturn has finally stabilised. Rental rates have levelled out at sustainable levels, helping retailers manage costs while laying the foundation for future rental growth. E-commerce remains a dominant force, but the appeal of physical retail endures.

Retail rebound

A visit to Dundrum in Dublin or Brent Cross in London confirms that in-person shopping is still relevant. Occupancy is high in destination centres, and tenant demand is strong.

With limited to no new developments in the Irish market, the threat of market oversupply is low, supporting the potential for gradual asset value appreciation, and in the meantime solid income streams.

Data from the Bannon Retail Pulse reinforces this message. Shopping centre footfall in November 2024 was 5.7 per cent higher than the previous year, translating into a 7.4 per cent increase in sales.

Retail parks have outperformed even pre-Covid benchmarks, with footfall up 9.3 per cent compared to 2019, demonstrating resilience and continued demand.

The wider economic landscape is also playing a role.

Ireland’s economy remains strong, and consumer spending is expected to rise despite inflationary pressures. The recent increase in the minimum wage is likely to inject additional spending power into the market, further supporting retail growth, despite costs concerns from retailers themselves.

Across Europe, the recovery is evident. Klépierre, a leading shopping centre operator, reported a 7 per cent increase in footfall during Black Friday 2024, with a remarkable 13.3 per cent rise in France alone.

Strong leasing activity prompted the company to revise its financial forecasts upwards after recording a 6.3 per cent rise in like-for-like rental income over the first three quarters of the year.

Hammerson, led by chief executive Rita-Rose Gagné, which owns retail assets across the UK, Ireland (notably Dundrum) and France, has pivoted towards urban retail destinations that integrate residential and leisure spaces.

This shift reflects a broader evolution in retail property, where shopping centres are no longer just about commerce but about creating mixed-use, experience-driven destinations.

Bolstering confidence

Several major transactions have highlighted this renewed confidence.

The €575 million sale of Blanchardstown Centre to SVP was a significant moment, involving not just the shopping centre but also two retail parks, an office block, and land with planning permission for 1,000 new apartments.

The Square in Tallaght, another notable transaction, was acquired by Eagle Street for €130 million in Q3, while Blackpool Shopping Centre and Retail Park changed hands for €49.5 million.

Meanwhile, large-scale retail loans have been refinanced, including those for Liffey Valley Shopping Centre and Dundrum Town Centre.

With a significant portion of prime retail assets now traded or refinanced, fewer retail properties are expected to come to market in 2025, which may result in lower overall investment volumes.

Two key sub-sectors are shaping investment trends — retail parks and shopping centres. Retail parks have proven to be especially resilient, benefitting from strong demand due to their accessibility and adaptability, particularly as click-and-collect services continue to expand.

Bannon’s report indicates that retail park footfall is now 9.3 per cent ahead of pre-Covid levels, further reinforcing their robust performance. However, their resurgence has led to reduced yields, currently standing at approximately 5.25 per cent for retail warehouses.

Shopping centres, once deemed higher-risk investments and severely lacking liquidity, are also on the path to recovery, at least at the prime end. Vacancy rates are declining in many prime centres, while income yields remain attractive at around 8 per cent.

Hammerson has seen renewed investor interest after selling its stake in Value Retail, allowing it to streamline its focus on shopping centres with improved refinancing options.