Lauder Teacher launched its new report, Specialised Supported Housing in the UK: Private capital’s role in delivering essential social infrastructure, on Tuesday, 2nd December. Prepared by the Lauder Teacher research team, it represents the first ever thorough, end-to-end analysis of the UK Specialised Supported Housing sector from a capital markets perspective.

This matters because Specialised Supported Housing sits at the intersection of three structural realities: a rising population with complex support needs, a persistent shortage of suitable accommodation, and sustained pressure on public finances. Despite its importance, the sector has historically been poorly understood. Debate has tended to focus on isolated regulatory issues, individual market episodes, or anecdote, rather than on a comprehensive assessment of how the sector functions, how value is created, and what is required for sustainable growth. This report was commissioned to address that gap.

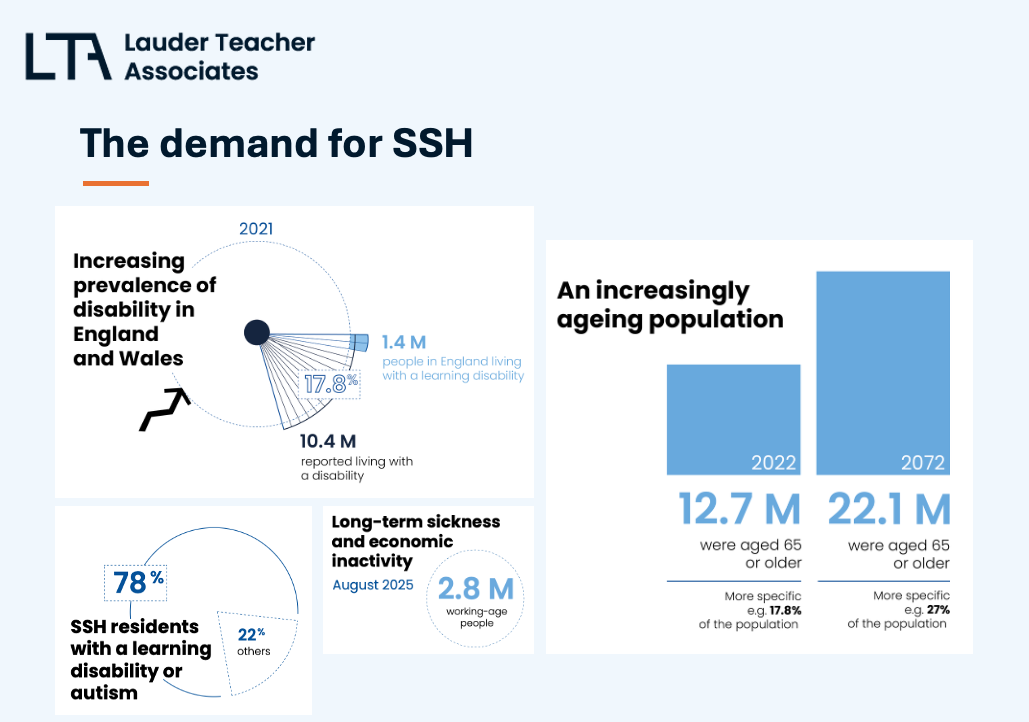

Specialised Supported Housing is designed for adults with higher-acuity needs, including people with learning disabilities, autism, mental health conditions, and physical disabilities. It provides adapted homes that enable individuals to live independently within the community while receiving a high level of support. These homes are not institutions. They are designed to blend into ordinary neighbourhoods, incorporating specialist adaptations and assistive technologies that support dignity, safety, and long-term inclusion.

The UK’s prevailing delivery model is investor-funded. Private capital finances the acquisition and development of properties, which are typically leased on long-term leases to Registered Providers. These providers manage the housing and tenancies and claim rents on behalf of residents. Care and support are delivered separately by specialist providers, commissioned through local authorities or the NHS. The separation of housing and care is central to the model. It protects residents’ security of tenure while allowing care packages to evolve as individual needs change.

Rental income is ultimately funded by the UK government via Housing Benefit. Within Specialised Supported Housing, rents are exempt from Local Housing Allowance caps, reflecting the higher costs associated with specialist design, adaptations, and ongoing management. This structure has enabled the mobilisation of private capital at scale, but it also places a premium on governance, compliance, and operational capability across the sector.

Demand for Specialised Supported Housing is substantial and rising for structural reasons. Demographic trends, including an ageing population and the prevalence of disability, are compounded by increasing levels of long-term sickness and complex support needs. Current estimates suggest that England will require approximately 167,000 additional supported housing units by 2040 simply to keep pace with population change. The undersupply is already material, and without sustained delivery it will continue to widen.

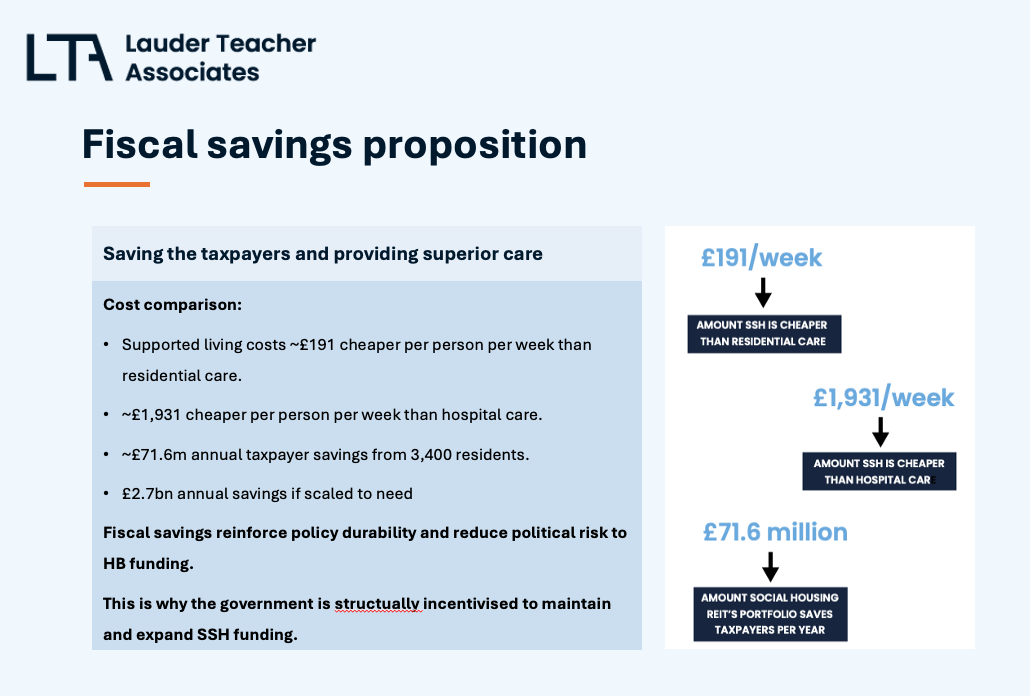

The report sets out why Specialised Supported Housing is, at its best, fiscally and socially compelling. It facilitates independent living, improves resident wellbeing, and can deliver significant savings for the public purse when compared with institutional alternatives such as long-stay hospital care or traditional residential settings. Impact reporting demonstrates that well-run schemes can generate substantial, recurring savings while delivering better outcomes for residents.

For investors, the attraction lies in the combination of long-duration, government-funded income characteristics and measurable social value. Leases are commonly inflation-linked, and cashflows can be defensive relative to conventional real estate. However, a central conclusion of the report is that this is not a passive asset class. The credibility and sustainability of the model depend on governance, operational engagement, and alignment of incentives between investors, Registered Providers, care partners, and commissioners.

That conclusion is grounded in experience. Past market difficulties and the reputational damage they caused were largely the result of misaligned structures, weak governance, and insufficient oversight. The sector’s future therefore depends on continued evolution. This includes fairer lease structures, stronger Registered Provider governance, consistent quality standards, and improved transparency and data. In the most forward-looking parts of the market, this shift is already evident, with Specialised Supported Housing increasingly treated as operational real estate rather than a simple long-lease income trade.

Policy and regulation will play a decisive role in determining whether the UK can scale what works. Recent legislative developments provide a framework for improved oversight and standards. The next phase must focus on implementation and practical reform. Our report highlights the need for clearer tiering across housing-with-support, stronger national data and commissioning infrastructure, support for Registered Provider professionalisation and capacity, and the enabling of mixed funding models to address gaps for residents who fall outside strict exemption criteria.

The overarching conclusion is straightforward. Specialised Supported Housing should be formally recognised as essential social infrastructure. As with other critical infrastructure sectors, public balance sheets alone cannot meet the scale of demand. Private capital has a legitimate and necessary role to play, provided it is deployed responsibly and managed actively. Structured correctly, Specialised Supported Housing can deliver long-term, stable and growing income while transforming lives and saving the taxpayer money, providing a rare alignment of financial return and social good.

Lauder Teacher welcomes engagement with investors, policymakers, commissioners, Registered Providers, and care partners on the findings, the evidence base, and the practical steps required to scale best practice across the sector.

Click here to download the full report: LauderTeacher SSH Report December 2025