The UK and Irish real estate markets underwent a transformative year in 2024, characterised by contraction, mergers, and cautious optimism. After years of declining capital values, signs of recovery began to emerge, buoyed by stabilising inflation and the initial stages of base rate cuts. In a significant milestone, the London market saw positive capital inflows in November, ending a 41-month slump.

Consolidation Through M&A

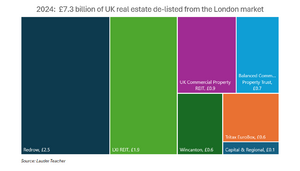

Merger and acquisition (M&A) activity shaped the real estate landscape, underscoring the growing importance of scale for listed property companies. Among the most prominent transactions were LondonMetric’s acquisition of LXi REIT and Tritax Big Box’s purchase of UK Commercial Property REIT. Brookfield, the private equity giant, outmanoeuvred SEGRO in a competitive bid for Tritax Eurobox, further highlighting the influence of private capital.

The six largest listed property firms—SEGRO, Landsec, Unite, LondonMetric, British Land, and Tritax Big Box—now account for over half the market value of the 47 UK REITs. This dominance illustrates a widening disparity, as smaller REITs struggle with liquidity constraints and declining institutional interest. For many of these smaller entities, M&A remains a lifeline, with options limited to merging with larger companies or combining to achieve greater scale.

Private capital played a key role in driving M&A activity, with firms like Brookfield exploiting the undervaluation of public markets. Sovereign wealth funds and other institutional investors also capitalised on their ability to deploy funds more quickly and cost-effectively than their publicly listed counterparts. However, this growing reliance on private capital raises concerns about the future competitiveness of the listed sector.

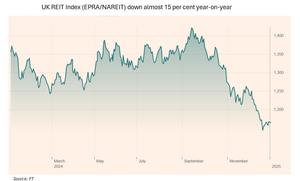

Share Price Performance

Share price performance among major listed property companies reflected the challenging environment. SEGRO experienced a share price decline of over 20%, surpassing the sector average of 15%, as negative revaluations weighed on the market. However, with asset repricing for prime industrial properties largely complete, SEGRO’s strong fundamentals offer prospects for recovery in 2025.

British Land, bolstered by its focus on retail parks, saw a smaller decline of 10%, outperforming the sector by 5%. Retail properties, being less sensitive to base rate increases, provided a measure of stability. Similarly, Hammerson outperformed the market with a modest share price gain of 1.1%, supported by strong dividend yields and high-quality retail assets.

Looking ahead, M&A is expected to remain a major theme in 2025, as smaller REITs face mounting pressure to consolidate and address structural disadvantages. However, the contraction in the number of listed REITs raises questions about the sector’s ability to offer diverse real estate exposure for investors.

IPO Activity and Market Challenges

Renewed interest in UK REITs, driven by tax advantages and transparency, was tempered by the failure of the Special Operations REIT IPO, which failed to reach its £250 million target. This highlighted ongoing investor scepticism towards niche REITs in a market increasingly dominated by private capital and larger players. The setback serves as a reminder of the importance of scale, clear value propositions, and well-timed market entry for prospective entrants.

In Ireland, the REIT structure remains uncompetitive, with no IPO activity expected in the near term. Policymaker intervention will be crucial to revitalise the sector and attract investment.

Economic Challenges and Resilient Sectors

Inflation, which appeared under control at the start of the year, resurfaced as a challenge by mid-2024, driven by rising government borrowing and wage pressures. While base rate cuts began towards the year’s end, these were more modest than anticipated, creating uneven conditions for the property sector.

Amidst these challenges, certain sectors displayed resilience.

Retail parks and shopping centres, once considered underperforming, saw renewed interest from investors and occupiers. British Land and Landsec expanded their retail portfolios to take advantage of this trend. Meanwhile, the industrial and logistics sectors continued to thrive, driven by e-commerce growth and supply chain reconfigurations.

However, the office market presented a mixed picture, with demand concentrated on sustainable prime assets, while secondary offices struggled.

Ireland: Contrasts in Performance

In Ireland, IRES REIT faced a tough year, with its share price declining by 19%. Dividend cuts and regulatory challenges deterred investors, despite the stability of its core assets. Recovery in 2025 may hinge on asset disposals and improved leadership to navigate market uncertainties.

Cairn Homes and Glenveagh Properties, Ireland’s leading housebuilders, delivered contrasting results. Cairn’s share price soared by 76%, driven by strong revenue growth and partnerships with state agencies. Its gross margin of 22% rivalled those of larger UK housebuilders. Glenveagh’s share price rose by 28%, reflecting robust unit completions, although its 18.2% margin lagged behind Cairn’s.

Dalata Hotel Group, a major player in the Irish and UK hotel markets, expanded its portfolio with five new sites, including London and Dublin. However, external cost pressures and the Dublin Airport passenger cap contributed to a 6% share price decline. Looking ahead, prudent capital management will be vital as Dalata navigates potential external shocks.

Outlook for 2025

The recovery of the real estate market remains fragile, supported by stabilising property yields and easing inflationary pressures. The industrial and logistics sectors are expected to retain their resilience, while retail and hospitality could benefit from improving consumer sentiment. However, economic uncertainties, including inflation and geopolitical risks, may dampen these gains.

M&A will remain a defining theme, as listed property companies seek scale and efficiency in an increasingly competitive environment. The dominance of private capital is likely to persist, driving further public-to-private transactions. To remain competitive, listed firms will need to emphasise transparency and robust governance.

For investors, a cautious strategy will be essential. Opportunities exist in sectors such as logistics and retail parks, but risks associated with inflation and geopolitical instability warrant a balanced approach. As consolidation continues to reshape the landscape, M&A will be a central driver of performance in the year ahead.