Real Estate Funds: A Call for Innovation and Restructuring

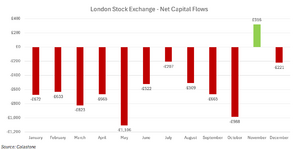

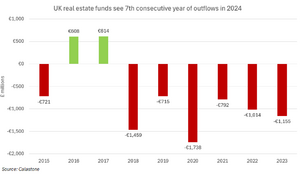

The real estate fund sector in the UK and Ireland continues to face mounting challenges, closing 2024 with full-year net outflows of £1.155 billion, according to the latest data from Calastone, the largest global funds network. This marks the seventh consecutive year of capital flight from the sector, reflecting persistent issues with liquidity mismatches, high interest rates, and a shifting investment landscape. In stark contrast, equity funds saw record-breaking inflows of £27.22 billion, underscoring the growing gap between real estate funds and other asset classes.

With investor sentiment increasingly favouring equities and bonds, real estate funds must evolve to regain confidence and secure their relevance in today’s competitive market.

A Landscape Under Stress

High Interest Rates and Market Volatility

High interest rates continue to be a defining challenge for real estate funds. Despite recent cuts by the Bank of England and European Central Bank, rates remain elevated, suppressing property valuations and making real estate less attractive than higher-yielding alternatives like bonds. Fixed income funds saw inflows of £1.29 billion in 2024, rebounding in the latter part of the year as yields surged.

Post-Pandemic Structural Shifts

The pandemic has permanently altered demand dynamics in real estate. Office spaces face reduced occupancy rates due to the adoption of hybrid work models, while retail properties continue to struggle with the dominance of e-commerce. These structural shifts mirror the challenges faced by other underperforming sectors, such as Asia-Pacific equity funds, which recorded significant outflows.

Liquidity Mismatch in Open-Ended Funds

The illiquid nature of real estate assets remains a major obstacle for traditional open-ended funds, which promise daily liquidity. This mismatch has repeatedly led to redemption suspensions during periods of market stress, further eroding investor trust. In contrast, passive equity funds have gained traction, attracting £29.65 billion in 2024 due to their transparency and cost-efficiency—qualities real estate funds must increasingly prioritise.

Learning from Equity and Bond Markets

Global and Passive Equity Funds as Benchmarks

Global equity funds absorbed £19.52 billion in inflows in 2024, while passive equity funds captured a record-breaking £29.65 billion. These sectors have benefitted from cost-efficient structures, transparency, and alignment with global growth trends. Real estate funds can adopt similar strategies, such as diversifying into high-demand sub-sectors like logistics and residential developments, which align with long-term macroeconomic trends.

Resilience of Fixed Income and Money Market Funds

Fixed income funds struggled mid-year but rebounded as yields surged, finishing with modest inflows. Meanwhile, money market funds, a traditional safe-haven asset class, attracted £1.86 billion, their best year on record. Real estate funds could emulate these sectors by focusing on income-generating assets with stable returns, catering to cautious investors seeking consistent income.

Underperformance of UK-Focused Funds

UK-focused equity funds recorded outflows of £9.56 billion in 2024, continuing their streak of negative performance. This mirrors the challenges faced by UK real estate funds, where investor confidence has waned. Both sectors must address concerns about growth potential and valuation to reverse these trends.

Strategic Recommendations for Restructuring

Adopt Closed-Ended Structures

Transitioning to closed-ended structures, such as Real Estate Investment Trusts (REITs), can address liquidity mismatches. These models allow investors to trade shares on secondary markets, reducing the reliance on asset sales to meet redemptions.

Introduce Redemption Gates and Notice Periods

For funds that retain open-ended models, implementing redemption gates or extending notice periods can help manage liquidity and prevent forced asset sales during periods of heightened withdrawals.

Diversify Portfolios Across Growth Sectors

Real estate funds should diversify into high-growth areas such as logistics hubs, data centres, and build-to-rent developments. These sectors align with macroeconomic trends, offering stability and growth potential.

Leverage Technology for Operational Efficiency

Proptech innovations can enhance fund management and transparency. Blockchain can simplify transactions, while AI-driven analytics provide real-time valuations and insights. Adopting these tools can appeal to a new generation of tech-savvy investors.

Strengthen ESG Integration

Investors increasingly prioritise environmental, social, and governance (ESG) factors. Real estate funds must improve their ESG credentials by focusing on green buildings and renewable energy projects, aligning with investor values and regulatory incentives.

Comparing Real Estate Funds to Other Asset Classes

The contrast between real estate funds and other investment sectors in 2024 is stark. Equity funds, buoyed by global diversification and passive strategies, saw record-breaking inflows, while real estate funds experienced continued outflows. Even within bonds, corporate and high-yield funds outperformed, highlighting the importance of targeting specific niches.

Money market funds demonstrated the value of stability, attracting cautious investors during volatile periods. Real estate funds could benefit by positioning themselves as a source of steady income, leveraging assets like long-term rental properties or renewable energy projects to attract risk-averse capital.

A Path Forward

The latest data underscores the urgent need for real estate funds to adapt. By learning from the success of global equities and passive strategies, leveraging diversification, and addressing liquidity concerns, these funds can reposition themselves for long-term growth.

While the challenges are significant, they also present opportunities. Real estate funds must prioritise transparency, innovation, and alignment with market trends to remain relevant in today’s investment landscape. The lessons are clear—the time for transformation is now.